ESG & Industry Updates

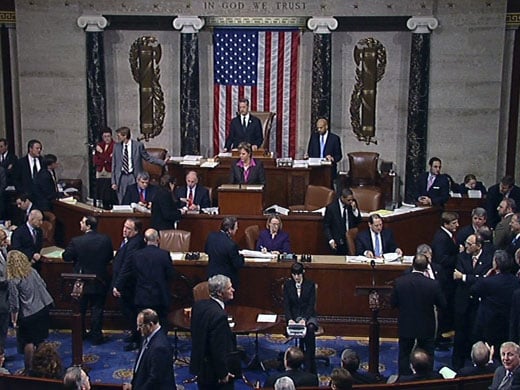

BREAKING: House Passes Bill to Lift Crude Oil Export Ban

Posted by Ed Burke on Oct 9, 2015 2:23:45 PM

Topics: US Crude Exports, CRUDE, export ban

Subscribe to Email Updates

Recent Posts

Posts by Topic

- Carbon Emissions (42)

- Climate Change (33)

- renewable energy (32)

- Oil & Energy Magazine (27)

- EPA (24)

- Massachusetts (22)

- Biden Administration (18)

- decarbonization (15)

- Biodiesel (12)

- natural gas (12)

- EPA Mandate (11)

- RFS (11)

- Solar (11)

- Biofuels (10)

- Keystone XL (10)

- methane (10)

- Clean Energy (9)

- offshore wind (9)

- Energy Independence (8)

- Energy Infrastructure (8)

- Safety (8)

- Biodiesel Tax Credit (7)

- Emissions (7)

- Ethanol (7)

- Trump Administration (7)

- ev (7)

- Cellulosic Ethanol (6)

- EV Charger (6)

- Inflation Reduction Act (6)

- RINs (6)

- environmental justice (6)

- Fracking (5)

- Technology (5)

- US Crude Exports (5)

- Utility Rates (5)

- electric vehicles (5)

- maine (5)

- tesla (5)

- ACT (4)

- Mass DOER (4)

- TransCanada (4)

- battery (4)

- fuel management (4)

- massachusetts biodiesel mandate (4)

- obama (4)

- paris accord (4)

- remote tank monitoring (4)

- CARB (3)

- CRUDE (3)

- Carbon Capture (3)

- Clean Fuel Production Credit (3)

- E85 (3)

- Emergency Fuel (3)

- Massachusetts Clean Cities (3)

- Waste Feedstock Biodiesel (3)

- china (3)

- clean power plan (3)

- electricity rates (3)

- net-zero (3)

- renewable diesel (3)

- solid state battery (3)

- AI (2)

- AVs (2)

- Bioheat (2)

- Commodities (2)

- Congress (2)

- Customer Service (2)

- DOT (2)

- EIA (2)

- Emergency Generator Program (2)

- HFCs (2)

- Hurricane Sandy (2)

- IMO 2020 (2)

- MIT (2)

- Marinas (2)

- New York (2)

- Refinery Closures (2)

- Safe Driving Policy (2)

- TCI (2)

- US Energy Boom (2)

- ZEV (2)

- autonomous vehicles (2)

- clean air act (2)

- clean heat standard (2)

- coal (2)

- driver shortage (2)

- emergency response (2)

- environment (2)

- ferc (2)

- geothermal (2)

- hydro-electric (2)

- hydrogen (2)

- national grid (2)

- net metering (2)

- power plant emissions (2)

- power plants (2)

- railcar regulations (2)

- tariff (2)

- vineyard wind (2)

- API (1)

- Air conditioning (1)

- Baiji Refinery (1)

- Blend Wall (1)

- Brent Crude (1)

- Brent vs WTI (1)

- CFCs (1)

- Cell Phone Policy (1)

- Clean Water Act (1)

- DEF (1)

- Election Results (1)

- Electrical Grid (1)

- Energy Efficiency (1)

- Environmental Impact Study (1)

- Environmentally Friendly Products (1)

- Ethanol Tax Credit (1)

- FEMA (1)

- Fiscal Cliff (1)

- Gas Tax (1)

- Gasoline Supply Crunch (1)

- HDVC (1)

- Hazmat (1)

- Heat Tax (1)

- Highway Trust Fund (1)

- Holyoke (1)

- Hybrid (1)

- ISIS (1)

- Iraq (1)

- Kigali Amendment (1)

- MOC (1)

- Market analysis (1)

- Mayflower (1)

- Montreal Protocol (1)

- NORA (1)

- Natural Gas Pipeline Explosion (1)

- New Jersey (1)

- OBB (1)

- Oil Barrel Tax (1)

- PFC (1)

- Pegasus Pipeline (1)

- Propane Autogas (1)

- Stimulus (1)

- Syria (1)

- Tank Truck Safety Training (1)

- Tax Increases (1)

- Tier 3 Gasoline Standard (1)

- Times Square (1)

- VEEP (1)

- Workplace Risk (1)

- agriculture (1)

- algonquin pipeline (1)

- alternative energy (1)

- altwheels (1)

- astm (1)

- bionic leaf (1)

- bitcoin (1)

- boston (1)

- covid-19 (1)

- energy storage (1)

- eversource (1)

- export ban (1)

- fixed pricing (1)

- fuel (1)

- fuel efficiency (1)

- fuel marketers news (1)

- gas leaks (1)

- heating oil (1)

- hurricane harvey (1)

- inflation (1)

- irving oil (1)

- marketing (1)

- nuclear (1)

- online fuel buying (1)

- ozone (1)

- photovoltaic (1)

- pilot program (1)

- pipeline (1)

- propane (1)

- renewable natural gas (1)

- rggi (1)

- russia (1)

- sanctions (1)

- senate (1)

- shale (1)

- social media (1)

- social media for business (1)

- space (1)

- tablets (1)

- tennessee pipeline (1)

- ukraine, (1)

- value added services (1)