ESG & Industry Updates

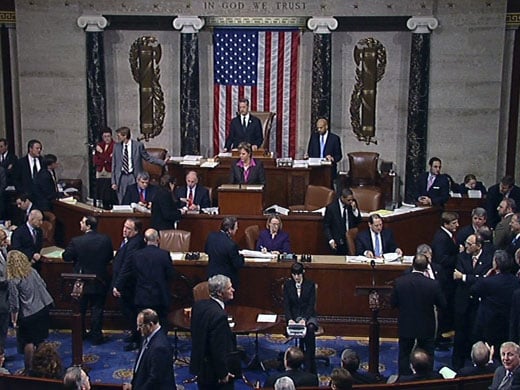

BREAKING: House Passes Bill to Lift Crude Oil Export Ban

Posted by Ed Burke on Oct 9, 2015 2:23:45 PM

Topics: US Crude Exports, CRUDE, export ban

Would CRUDE Exporting Increase Your Pain at the Pump? Not Necessarily

Posted by Ed Burke on Jan 7, 2014 1:43:00 PM

As we’ve discussed, proponents of overturning the ban on US Crude Exports cite the economic gain to be had, including jobs to be created.

Topics: Energy Independence, Fracking, CRUDE

Congress is reportedly considering overturning laws banning US Oil Producers from exporting Crude. The law originally went into place in the 1970’s largely in reaction to embargoes that raised “scarcity” concerns – essentially, blocking export is supposed to safeguard from scarcity in domestic supply. This is timely on their part – as we have seen for the first time since 1995, US Crude production has exceeded imports. What do they have to do with each other? In the absence of an export potential, or at least one not slowed and more expensive due to refining, US crude production will hit a plateau or worse. But why?

Refined oil (gasoline and diesel) can be exported under current US law, and exports have grown substantially in recent years. The issue is, however, that the shale oil boom is producing huge volumes of light crude. In order to export, these huge amounts of crude need to be refined, which is difficult, costly and will ultimately slow production over time. The Council on Foreign Relations sums the issue up nicely in the following quote:

Topics: Energy Independence, US Crude Exports, US Energy Boom, CRUDE

Subscribe to Email Updates

Recent Posts

Posts by Topic

- Carbon Emissions (42)

- Climate Change (33)

- renewable energy (32)

- Oil & Energy Magazine (27)

- EPA (24)

- Massachusetts (22)

- Biden Administration (18)

- decarbonization (15)

- Biodiesel (12)

- natural gas (12)

- EPA Mandate (11)

- RFS (11)

- Solar (11)

- Biofuels (10)

- Keystone XL (10)

- methane (10)

- Clean Energy (9)

- offshore wind (9)

- Energy Independence (8)

- Energy Infrastructure (8)

- Safety (8)

- Biodiesel Tax Credit (7)

- Emissions (7)

- Ethanol (7)

- Trump Administration (7)

- ev (7)

- Cellulosic Ethanol (6)

- EV Charger (6)

- Inflation Reduction Act (6)

- RINs (6)

- environmental justice (6)

- Fracking (5)

- Technology (5)

- US Crude Exports (5)

- Utility Rates (5)

- electric vehicles (5)

- maine (5)

- tesla (5)

- ACT (4)

- Mass DOER (4)

- TransCanada (4)

- battery (4)

- fuel management (4)

- massachusetts biodiesel mandate (4)

- obama (4)

- paris accord (4)

- remote tank monitoring (4)

- CARB (3)

- CRUDE (3)

- Carbon Capture (3)

- Clean Fuel Production Credit (3)

- E85 (3)

- Emergency Fuel (3)

- Massachusetts Clean Cities (3)

- Waste Feedstock Biodiesel (3)

- china (3)

- clean power plan (3)

- electricity rates (3)

- net-zero (3)

- renewable diesel (3)

- solid state battery (3)

- AI (2)

- AVs (2)

- Bioheat (2)

- Commodities (2)

- Congress (2)

- Customer Service (2)

- DOT (2)

- EIA (2)

- Emergency Generator Program (2)

- HFCs (2)

- Hurricane Sandy (2)

- IMO 2020 (2)

- MIT (2)

- Marinas (2)

- New York (2)

- Refinery Closures (2)

- Safe Driving Policy (2)

- TCI (2)

- US Energy Boom (2)

- ZEV (2)

- autonomous vehicles (2)

- clean air act (2)

- clean heat standard (2)

- coal (2)

- driver shortage (2)

- emergency response (2)

- environment (2)

- ferc (2)

- geothermal (2)

- hydro-electric (2)

- hydrogen (2)

- national grid (2)

- net metering (2)

- power plant emissions (2)

- power plants (2)

- railcar regulations (2)

- tariff (2)

- vineyard wind (2)

- API (1)

- Air conditioning (1)

- Baiji Refinery (1)

- Blend Wall (1)

- Brent Crude (1)

- Brent vs WTI (1)

- CFCs (1)

- Cell Phone Policy (1)

- Clean Water Act (1)

- DEF (1)

- Election Results (1)

- Electrical Grid (1)

- Energy Efficiency (1)

- Environmental Impact Study (1)

- Environmentally Friendly Products (1)

- Ethanol Tax Credit (1)

- FEMA (1)

- Fiscal Cliff (1)

- Gas Tax (1)

- Gasoline Supply Crunch (1)

- HDVC (1)

- Hazmat (1)

- Heat Tax (1)

- Highway Trust Fund (1)

- Holyoke (1)

- Hybrid (1)

- ISIS (1)

- Iraq (1)

- Kigali Amendment (1)

- MOC (1)

- Market analysis (1)

- Mayflower (1)

- Montreal Protocol (1)

- NORA (1)

- Natural Gas Pipeline Explosion (1)

- New Jersey (1)

- OBB (1)

- Oil Barrel Tax (1)

- PFC (1)

- Pegasus Pipeline (1)

- Propane Autogas (1)

- Stimulus (1)

- Syria (1)

- Tank Truck Safety Training (1)

- Tax Increases (1)

- Tier 3 Gasoline Standard (1)

- Times Square (1)

- VEEP (1)

- Workplace Risk (1)

- agriculture (1)

- algonquin pipeline (1)

- alternative energy (1)

- altwheels (1)

- astm (1)

- bionic leaf (1)

- bitcoin (1)

- boston (1)

- covid-19 (1)

- energy storage (1)

- eversource (1)

- export ban (1)

- fixed pricing (1)

- fuel (1)

- fuel efficiency (1)

- fuel marketers news (1)

- gas leaks (1)

- heating oil (1)

- hurricane harvey (1)

- inflation (1)

- irving oil (1)

- marketing (1)

- nuclear (1)

- online fuel buying (1)

- ozone (1)

- photovoltaic (1)

- pilot program (1)

- pipeline (1)

- propane (1)

- renewable natural gas (1)

- rggi (1)

- russia (1)

- sanctions (1)

- senate (1)

- shale (1)

- social media (1)

- social media for business (1)

- space (1)

- tablets (1)

- tennessee pipeline (1)

- ukraine, (1)

- value added services (1)