Iraqi Turmoil Rocks the NYMEX

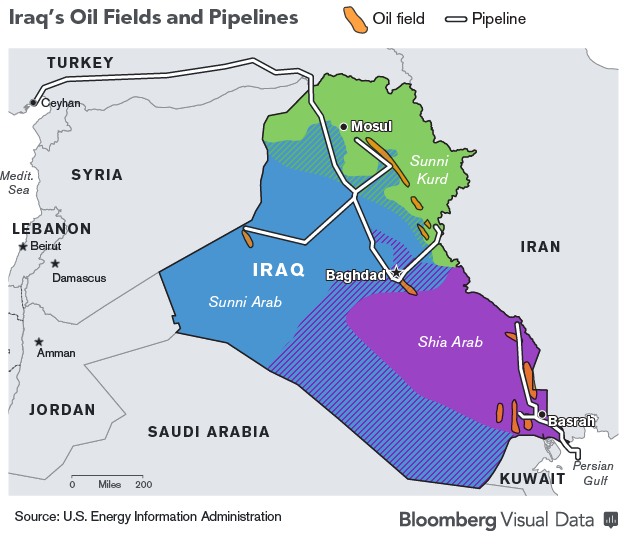

(Image credit: US EIA via Bloomberg Visual Data - Bloomberg Businessweek 6-12-14)

Both Brent and WTI shot up 2% today on last nights news that ISIS insurgents in Iraq captured Tikrit and Baiji, and were continuing their march towards Bahgdad.If you were watching the screen, you also saw ULSD shoot up .085 to 2.9893 and RBOB hit 3.0837, up .0829 on the day in reaction.

Iraqi production levels have been stable around 3 million barrels per day, making Iraq OPECs second largest producer (behind Saudi Arabia) - so the supply concerns we're seeing push prices up at this intensity level are not unfounded.

Essentially all of Iraq's oil production comes from the southern, Shia portion of the country by Basra, (see map from Bloomberg above) where militant influence is essentially non existant (at least in comparison) - so some speculate that even should the Baiji refinery or additional cities fall, actual supply is unlikely to be affected as the area is well guarded and safe. However, it pays to keep in mind that no one saw Mozul or Tikrit being as vulnerable as they apparently were - the invasion of Mozul saw over 500,000 people flee the city in 12 hours, including basically the entire coalition of American-trained Iraqi security forces because of the level of violence and choas that erupted. It's less likely that would happen further south, given the relatively small insurgent force and the steeper odds they would face in terms of fighting back - but its certainly not an entirely unreasonable fear.

The Obama administration has stated they are "considering all options" - air strikes, drones, etc but have not made a decision at this time. It would seem unlikely that an attempt to garner public support for re-entrance to Iraq would be an easy (or possible) task, all things considered. Ironically, the air strikes on Syria that the administration faced such backlash for last year were directed at stopping the violence in the area that involved ISIS - the same group now surging in Iraq. Not a good sign for approval for Iraqi strikes. Thus far neither the UN or US has said they will step in to aid the Iraqi government - a fact that it certainly not easing concerns in the market, one would think.

In the grand scheme, considering price volatility and levels as a whole, we're fortunate that some areas (like the US) have seen production booms that have offset some of the drop offs from OPEC nations (mainly Libya) as its helped keep prices overall more stable - the jump in 2012 for example would probably have shot way past a 2% spike. If supply gets disrupted in Iraq though, given its the second largest OPEC producer, that may cease to be the case, which is probably the more far reaching concern pushing prices than isolated fighting would on its own.