Markets Should-ing All Over Expectations

It has been a tough start for many this summer, the heavy rains throughout the region have delayed projects, hindered marina activity, and limited travel in general. New Englanders, like the market, are resilient. We always find a way to bounce back, move forward and DKB will be right there with you.

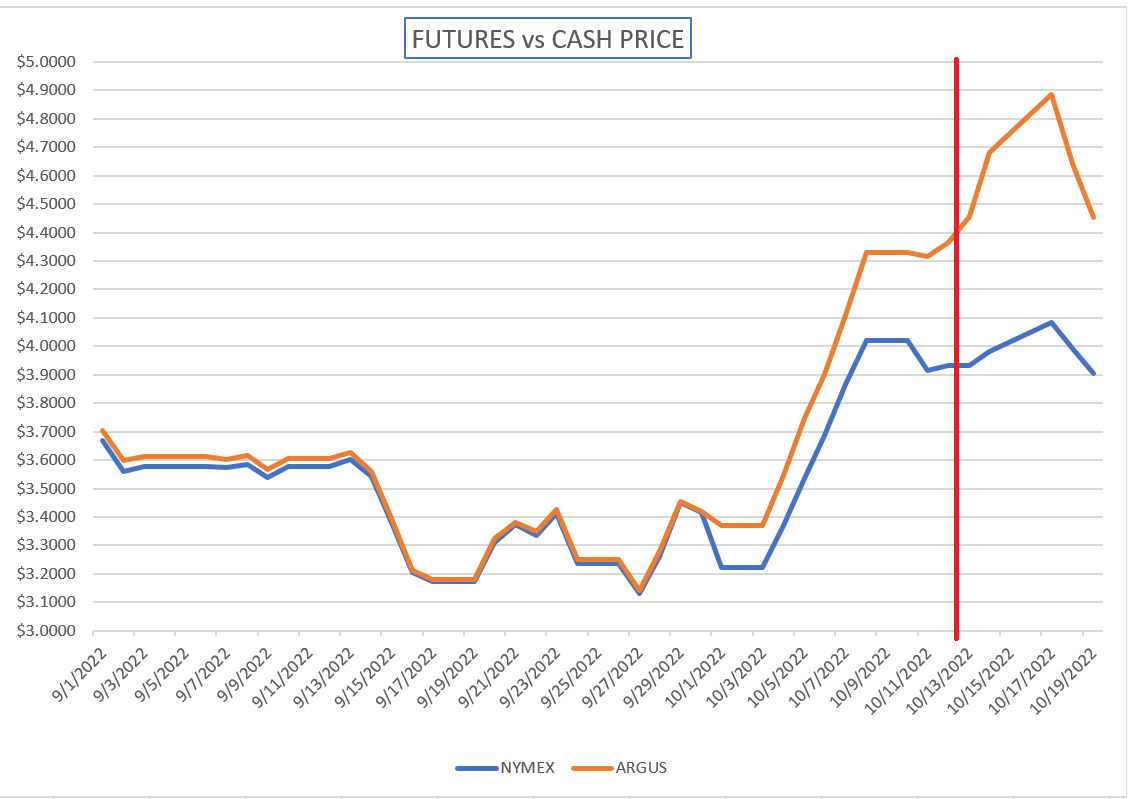

There seems to be somewhat of a divorce between what IS happening and what conventional wisdom says SHOULD happen in the fuels arena. Production cuts, inflation numbers, and demand figures have all weighed in on the direction the last week. The last several days saw diesel pricing break out of that $.20 range we’ve been discussing, unfortunately to the high side.

Inventories showed a large increase on crude and distillates this week, with an eye on diesel demand being at its lowest point in months, a staggering 12% lower than this time last year. Gas stocks were flat while demand fell about 8% to last week, again likely a weather related phenomenon. These numbers SHOULD send pricing lower.

A mixed sign on the Inflation front, JUNE saw inflation rise only 3%, its lowest gain in 2 years and a far cry from the 9% increase last June, and closer to the 2% FED target. This SHOULD make futures rise as an optimistic view remains of a stronger future. But, most anticipate another ¼ rise in rates by the Fed, thus increasing borrowing costs and forcing holders of oil to sell product to reduce overall costs and SHOULD push futures lower. The market appeared comfortable about $.20 ago and I would anticipate a return to that level in the coming weeks.

I speak directly with a number of you everyday, a new feature we have added is to give you and your team the ability to book some one on one time to discuss your specific needs and hurdles. Below is a link to book a call, TEAMs video call, or meeting…. I look forward to hearing from you!