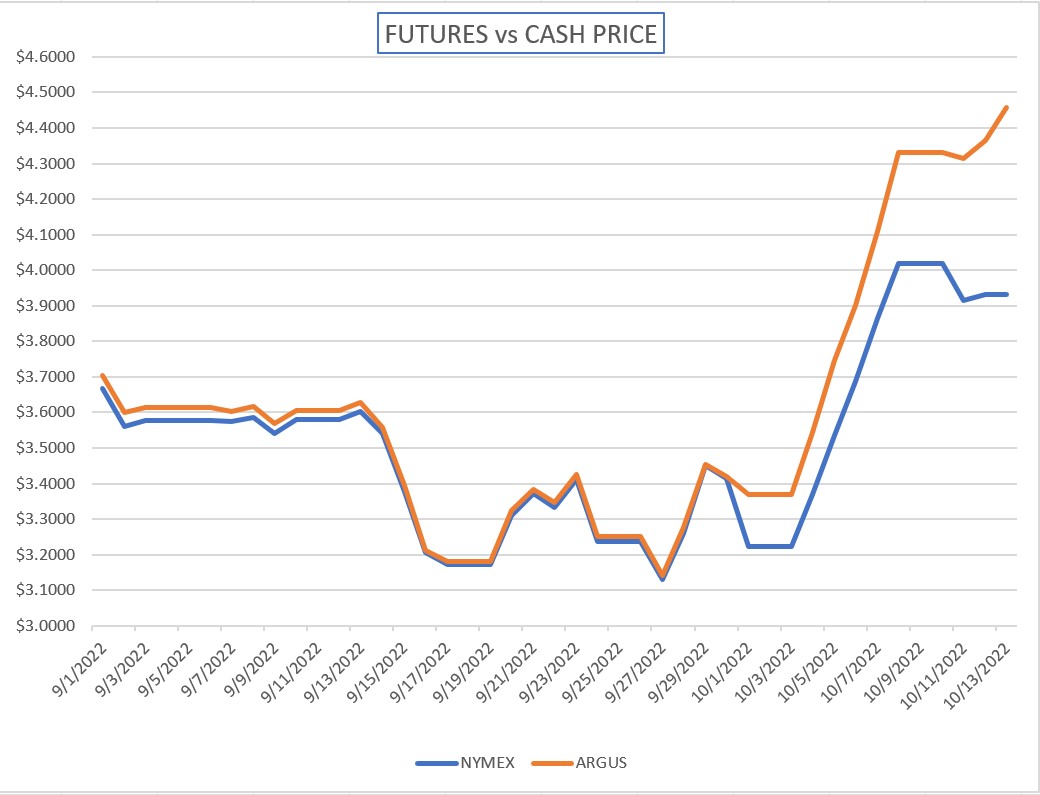

Cash vs NYMEX Blowout on Supply Concerns Keeps Diesel Elevated

If there is one thing that I am sure of in all my years in this Industry it is that Customers do not like surprises.

The last two weeks (or two years for that matter!) have certainly offered up many surprises. News over the last three days has highlighted “Crude prices falling”, however, the disconnect from Crude pricing to the finished diesel product pricing has never been more sharply contrasted. Front month Diesel futures have once again skyrocketed $.80 to touch the $4.00 level in the last two weeks for the fifth time. The rapid rise and rapid drop cycle doesn’t seem to be ending anytime soon.

The big surprises have come in the way of Cash Diesel prices rising more than futures. As illustrated above, diesel cash values have blown out over $.50 over futures values. The month prior they were practically even, and historically they tend to only be a few cents apart. So why?

Realistic concerns over product shortages in New York Harbor hit the market in the last several days as not many offers were taken on barges. What that means is that product is still moving overseas versus into US ports, thus slowing resupply and pushing up pricing for any product already in tank. Cash markets move racks more than futures do, although most only look at the NYMEX as the driver. These types of cash to screen blowouts are historically short lived. (We can only hope this is not another “historic” trend change, I think we can all agree that we’re tired of those).

Be sure your Supplier has adequate, guaranteed supply and the ability to get product to you as the fewer the surprises you have, the better.