Events of the past year/18 months have highlighted in the mainstream a problem that has been plaguing the Transportation Industry for well over a decade - namely, the growing driver shortage. This has been a particularly tough issue in the fuel side of the transportation sector, as the safety and licensing endorsements (like hazmat) are substantially more stringent than some other portions of the commercial driving arena.

ESG & Industry Updates

Biden's Offshore Wind Plan Bolsters NE Clean Energy Goals

Posted by Kelly Burke on Jul 22, 2021 11:11:53 AM

The Biden Administation has the ambitious goal of bringing 30 gigawatts of offshore wind online by 2030, and 1.4 of those gigawatts are slated to come from the New England coast.

Topics: Massachusetts, Carbon Emissions, renewable energy, Clean Energy, offshore wind

Maine Stalls on Path to First Statewide Consumer Owned Utility

Posted by Kelly Burke on Jul 14, 2021 11:07:00 AM

Maine lawmakers have been pushing for the state to create the first statewide, publicly owned utility in the US. The legislation proposed in June would have created the entity (Pine Tree Power) as a nonprofit utility that would use issued bonds to purchase the asset holdings of the current suppliers (Central Maine Power & Versant). The bill passed the House but stalled in the Senate, ultimately being defeated by one vote on questions raised about how the utility would cover the shortfall in property tax revenue that would arise from the exit of the current utilities. The shortfall was estimated at $90 million dollars, which is normally paid out to cities and towns.

Topics: Utility Rates, renewable energy, maine

The New Recovery Proposal: Infrastructure, Transportation & Climate Change, Oh My

Posted by Kelly Burke on Apr 2, 2021 4:18:58 PM

This Wednesday, the Biden Administration unveiled a 2 trillion dollar transportation, infrastructure and economic recovery package. The goal of the bill is to create jobs, fix/upgrade US infrastructure, and combat climate change as the country attempts to recover from the COVID induced economic slump.

Topics: Stimulus, Climate Change, covid-19, Biden Administration

MA Passes Landmark Climate Change & Environmental Justice Bill

Posted by Kelly Burke on Apr 1, 2021 3:07:36 PM

Friday, March 23rd, Massachusetts Governor Charlie Baker signed into law Senate Bill 9 "An Act Creating a Next Generation Roadmap for Massachusetts Climate Change Policy" that includes provisions described as "some of the most aggressive greenhouse gas emissions reductions targets in the country"

Topics: EV Charger, Massachusetts, Climate Change, Carbon Emissions, renewable energy, environmental justice

Maine Based AeroSpace Company breaks Bio Barriers at -14 & Zero G

Posted by Kelly Burke on Mar 17, 2021 9:46:00 AM

Maine-based bluShift Aerospace successfully launched and landed the first commercial rocket powered by biofuel on January 31st of this year. Not only did the rocket successfully launch running on bio, but it did so at a staggering -14 degrees fahrenheit!

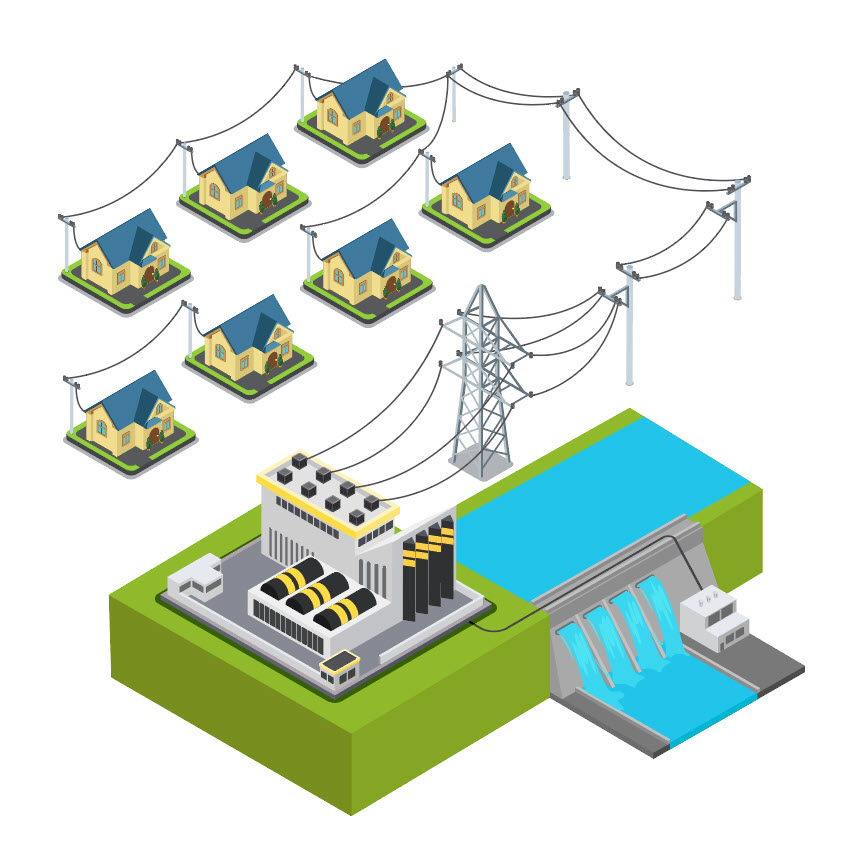

Maine Central Power Clears Regulatory Hurdle, Stalls on Legal Challenge

Posted by Kelly Burke on Feb 26, 2021 11:17:00 AM

Central Maine Power's proposal for a 145 mile electricity transmission line through the Western part of the State has cleared the final regulatory hurdle. Central Maine Power (Avangrid) recieved a Presidential Permit from the US Department of Energy for their $950 million dollar "New England Clean Energy Connect" (NECEC) Project to be able to cross the Canadian Border. (As an aside, if you want to read about the project in detail their website is a great resource: NECEC )

Topics: Carbon Emissions, renewable energy, maine, hydro-electric

New Administration, New Focus - Executive Orders & Industry Impacts

Posted by Kelly Burke on Jan 28, 2021 5:59:19 PM

The new Administration is off to a running start, as Wednesday saw a flurry of Executive Orders come out, many of which deal with climate change, and the oil & gas industry. There are a lot of items, and they are all pretty detailed with substantial backstory, but we are going to try and briefly touch on the three major items relevant to the industry and quickly go over the main points (or, try to at least!)

Topics: Keystone XL, Climate Change, clean power plan, Biden Administration, paris accord

MA refiles Vetoed Climate Change Bill, This Time with Potential Veto Proof Margin

Posted by Kelly Burke on Jan 22, 2021 1:58:54 PM

Last week Massachusetts Governor Charlie Baker vetoed a bill that committed Massachusetts to reducing carbon emissions to 85% of 1990 levels over the next 3 decades, with the goal being a 100% reduction versus 1990 levels. Included as well are interim 5 year goals, one of which is a 50% reduction by 2030. The ultimate goal of the bill is requiring Massachusetts to become carbon neutral by 2050 - which is a goal Baker has publicly endorsed throughout his tenure.

Topics: Massachusetts, Carbon Emissions

Climate Change Controversy Heats Up on Wood Pellets

Posted by Kelly Burke on Dec 22, 2020 10:48:08 AM

Topics: Climate Change, Carbon Emissions, renewable energy

Subscribe to Email Updates

Recent Posts

Posts by Topic

- Carbon Emissions (32)

- Climate Change (27)

- Oil & Energy Magazine (24)

- renewable energy (24)

- EPA (19)

- Biden Administration (14)

- Massachusetts (14)

- decarbonization (12)

- EPA Mandate (11)

- RFS (11)

- natural gas (11)

- Keystone XL (10)

- Solar (10)

- Biodiesel (9)

- Biofuels (9)

- Clean Energy (8)

- Energy Independence (8)

- methane (8)

- Energy Infrastructure (7)

- Ethanol (7)

- Safety (7)

- Cellulosic Ethanol (6)

- Emissions (6)

- RINs (6)

- Fracking (5)

- US Crude Exports (5)

- electric vehicles (5)

- maine (5)

- offshore wind (5)

- Biodiesel Tax Credit (4)

- EV Charger (4)

- Mass DOER (4)

- Technology (4)

- TransCanada (4)

- Utility Rates (4)

- massachusetts biodiesel mandate (4)

- obama (4)

- CRUDE (3)

- E85 (3)

- Emergency Fuel (3)

- Massachusetts Clean Cities (3)

- Waste Feedstock Biodiesel (3)

- clean power plan (3)

- environmental justice (3)

- ev (3)

- paris accord (3)

- remote tank monitoring (3)

- tesla (3)

- AVs (2)

- Bioheat (2)

- Carbon Capture (2)

- Commodities (2)

- Congress (2)

- Customer Service (2)

- DOT (2)

- EIA (2)

- Emergency Generator Program (2)

- Hurricane Sandy (2)

- IMO 2020 (2)

- MIT (2)

- Marinas (2)

- New York (2)

- Refinery Closures (2)

- TCI (2)

- US Energy Boom (2)

- autonomous vehicles (2)

- battery (2)

- china (2)

- coal (2)

- driver shortage (2)

- emergency response (2)

- environment (2)

- ferc (2)

- fuel management (2)

- geothermal (2)

- hydro-electric (2)

- hydrogen (2)

- national grid (2)

- net metering (2)

- power plant emissions (2)

- railcar regulations (2)

- API (1)

- Air conditioning (1)

- Baiji Refinery (1)

- Blend Wall (1)

- Brent Crude (1)

- Brent vs WTI (1)

- CFCs (1)

- Cell Phone Policy (1)

- Election Results (1)

- Energy Efficiency (1)

- Environmental Impact Study (1)

- Environmentally Friendly Products (1)

- Ethanol Tax Credit (1)

- FEMA (1)

- Fiscal Cliff (1)

- Gas Tax (1)

- Gasoline Supply Crunch (1)

- HFCs (1)

- Hazmat (1)

- Heat Tax (1)

- Highway Trust Fund (1)

- Holyoke (1)

- Hybrid (1)

- ISIS (1)

- Inflation Reduction Act (1)

- Iraq (1)

- Kigali Amendment (1)

- MOC (1)

- Market analysis (1)

- Mayflower (1)

- Montreal Protocol (1)

- NORA (1)

- Natural Gas Pipeline Explosion (1)

- New Jersey (1)

- Oil Barrel Tax (1)

- Pegasus Pipeline (1)

- Propane Autogas (1)

- Safe Driving Policy (1)

- Stimulus (1)

- Syria (1)

- Tank Truck Safety Training (1)

- Tax Increases (1)

- Tier 3 Gasoline Standard (1)

- Times Square (1)

- VEEP (1)

- Workplace Risk (1)

- algonquin pipeline (1)

- alternative energy (1)

- altwheels (1)

- astm (1)

- bionic leaf (1)

- bitcoin (1)

- boston (1)

- clean air act (1)

- covid-19 (1)

- electricity rates (1)

- energy storage (1)

- eversource (1)

- export ban (1)

- fuel efficiency (1)

- fuel marketers news (1)

- gas leaks (1)

- heating oil (1)

- hurricane harvey (1)

- inflation (1)

- irving oil (1)

- marketing (1)

- net-zero (1)

- ozone (1)

- photovoltaic (1)

- pilot program (1)

- pipeline (1)

- propane (1)

- renewable natural gas (1)

- russia (1)

- sanctions (1)

- senate (1)

- shale (1)

- social media (1)

- social media for business (1)

- solid state battery (1)

- space (1)

- tablets (1)

- tennessee pipeline (1)

- ukraine, (1)

- value added services (1)